2026: Big Housing Shift -Part 2

How do we get to a lower mortgage rate?

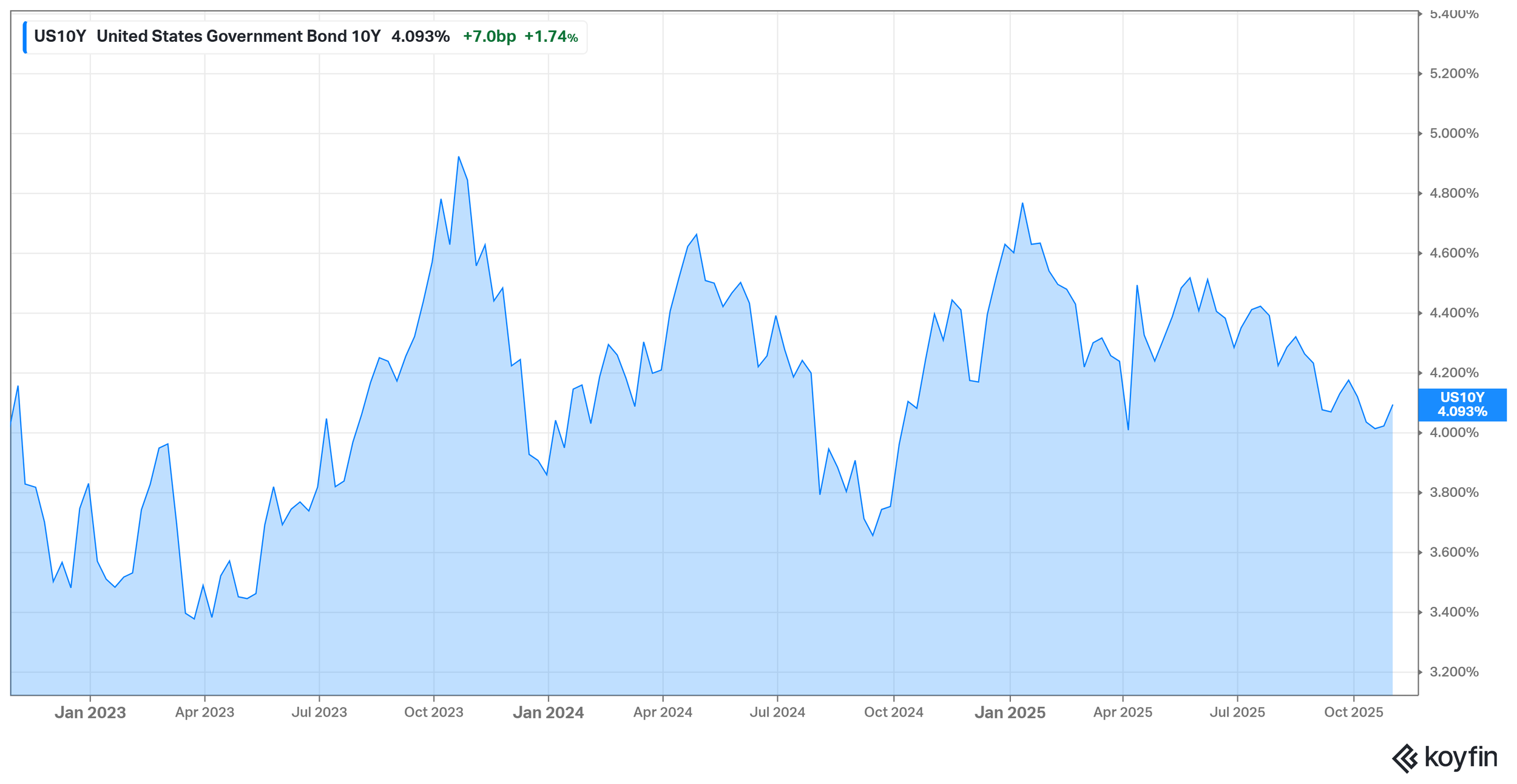

First, The 10 year treasury rate has moved lower, hovering around the 4% threshold. The 10 year treasury is the base reference point for the 30 year mortgage.

Inflation remains range bound with a downward bias, employment trends are mediocre, and credit events like the First Brands fiasco provide the Fed ample cover. Continued pressure from the administration + the expectations of a new Fed Chair in 2026 drives expectations about future fed funds rate, keeping the 10 year biased lower.

But the Fed Chair needs to play ball. He did not on October 29th, challenging the December rate cut. It’s priced into markets, why fight it?

Second, reduce the mortgage rate spread.

The additional yield above above 10 year treasury. Currently above 2%.

Recall, During the Fed’s quantitative easing (QE) program, it actively purchased Mortgage Backed Securities, effectively reducing this spread.

Since the inflation death spiral of 2022, the Fed switched to quantitative tightening (QT). Allowing mortgage bonds to mature and roll off the balance sheet. Forcing the open market to pick up the slack. Mr. Market does nothing for free, so spreads widen.

The Fed can start to reinvest proceeds or even begin buying MBS securities to reduce this spread.

And remember “everything is on the table.” There’s even talk of the administration allowing Fannie Mae and Freddie Mac to purchase MBS to control this spread.

Point # 2 What does this mean for 2026?

The Ai story is obvious. Markets are cyclical. Capital runs, sometimes with its hair on fire, to the trending “opportunities,” because this is now the new state of the world. And often there are nuggets of truth.

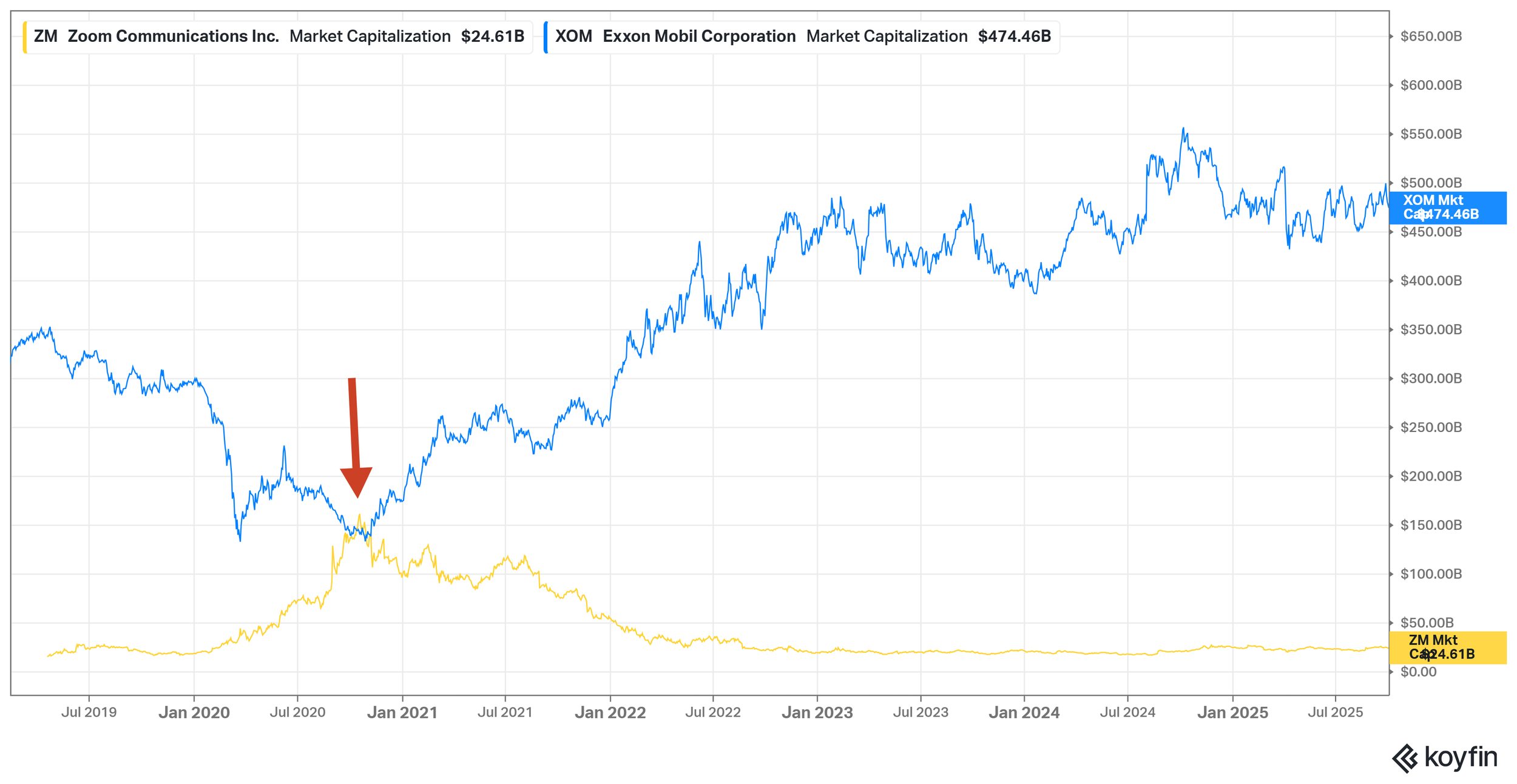

If we only look back to 2020, as the covid pandemic drove everyone into their homes, the stay at home theme exploded. Market participants chased hot stocks like Zoom and Peloton, extrapolating the current dynamics in perpetuity. At one point Zoom was valued more than Exxon.

Ah yes, an “efficient market”. Silly.

At the current moment its difficult to see what disrupts the current bull market. But I do ponder if there can be a handoff. Who else can join the party?

Because at the current tenor, those in the lower end are getting their pitchforks ready for the voting booth.

“Unfreezing” the housing market can awaken consumers. Reducing interest burden, create jobs, and stimulate the lower end consumer. When I say lower end, I’m no referencing the bottom 10%, I’m talking the bottom half. This cohort spends, because they have to.

There is a significant multiplier effect by awakening the housing market. It trickles everywhere. From retail and banking, down to core base commodities.

Perhaps this can awaken the S&P 493.

Are there consequences to this “stimulus?”

Yes, but that’ll come when the Fed is forced to return to interest rate hikes. We’ll have to worry about it then. Powell wants to worry about it now.

ReferencedFinancial Data via Koyfin.com 10.31.2025Trade groups push plan to let GSEs buy MBS to ease mortgage rates