Healthy Skepticism

And just like that, the Ai narrative begins to show fatigue. The market has shifted from a total buy in of the Ai narrative to a more nuanced perspective of assessing potential winners and losers of the Ai arms race.

Market narratives evolve and change in real time, digesting news and opinions into buy and sell decisions.

It’s more than coincidental that the Ai trade hit stall speed just after OpenAi CEO Sam Altman’s interview by investor Brad Gerstner on October 31st.

Brad asked Sam how they planned to meet $1.4 trillion in spending commitments with $13 billion in annual revenue. A perfectly legitimate question for anyone who can do simple arithmetic. Sam responded with a very defensive tone (brattish if you ask me). “Brad, if you want to sell your shares, I’ll find you a buyer.”

Not to be outdone by Altman, OpenAi CFO Sarah Friar, spoke at a Wall Street Journal Tech Live Event, where she called for a federal “backstop, the guarantee that allows the financing to happen,” referring to the financing of compute infrastructure.

The moderator clarified, “So some federal backstop for chip Investment.” Ms. Friar responded “Exactly”.

She later walked back this message with a LinkedIn post, followed by further rebuke from Sam Altman. White House Crypto and Ai czar David Sacks quickly shot down the idea.

“There will be no federal bailout for AI. The U.S. has at least 5 major frontier model companies. If one fails, others will take its place.”

— David Sacks 11/6/2025

I don’t buy it. I’m very skeptical of all this. It doesn't pass the vibe check. The walking back of very clear pointed questions, the defensive tonality, causes me to question their ultimate intent.

It also has consequences for the administration in my view.

The Federal Government + OpenAi = Midterm election losses = Lame duck presidency

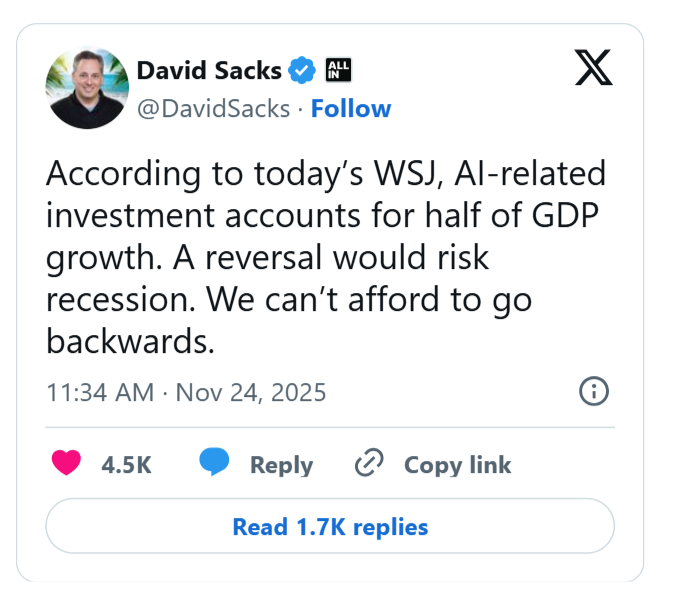

A few weeks later (2), David Sacks follows up his comments of no federal bailout of Ai, with a confusing statement about the reversing of Ai investment risks causing a recession. This sounds like “too big to fail” talk to me.

He comments later “Puzzled that anyone could interpret this post as supporting a bailout. I’ve already opposed that. Nor do I believe one is needed.”

The backtracking with this group is mind boggling.

Midterms will be won or lost on cost of living. No one wants to hear about even a hint of government involvement in backstopping Ai infrastructure.

Point #1 - This time is not different - Live from Fed Press Conference October 29th 2025 3

Victoria Guida (Politico) - On AI, I’m just wondering, it seems like a lot of the economic growth that we’ve been seeing is fed by investments in AI. So how worried are you about what the sudden contraction in tech investment would mean for the overall economy?

Chair Powell - This is—this is different in the sense that these companies—the companies that are so highly valued—actually have earnings and stuff like that. So you go back to the ’90s and the dot-com [period], they were—these were ideas rather than companies. And we’re—so there’s a clear bubble there, whereas the—I won’t go into particular names, but they actually have earnings, and it looks like they have business models and profits and that kind of thing. So it’s really a different thing.

Sometimes I feel like I live in a different reality than others, like I must not be able to read or think critically.

The 2000 technology bubble was very much driven by profitable technology businesses, delivering valuable goods and services. Cisco, Oracle, Microsoft all very real.

The Pets.com example gets thrown around frequently, but size matters, and at its peak was worth about $400 million.

Today, there is a whole private market ecosystem that is less transparent. OpenAi is estimated to be valued at $500 billion; it is profitless and expected so through 29’.6

The Fed chair’s statement is too dismissive in my opinion.

Point # 2 - “Risk Check”

Skepticism is healthy and a necessary component of market stability. The market will occasionally put investors through sanity checks, removing froth, testing conviction.

Stocks that had adopted parabolic price action, the kind I wrote about in October, have fallen significantly.

IPO darlings Circle, Figma, and CoreWeave, down meaningfully in November.

Bitcoin and Ethereum down 17% and 22%, respectively.

Even some modest weakness in the AI behemoths Nvidia and Microsoft both down about 13% and 5% for the month.

All healthy price action in my opinion. Risk taking kept in check. The bubble argument weakens when the bears and skeptics are out.

Point #3 - What to make of the “Big Short”

The Big Short himself, Michael Burry, was thrust into the public spotlight recently with his recent regulatory filing citing some bearish bets against Nvidia and Palantir. He followed up with a post on “X”, stating that the hyperscalers are overstating earnings by extending the useful life of their Ai chip investments.(3)

What do you do with his argument?

Is this a novel perspective?

Not really, I’ve seen this argument used by analysts throughout my career. Sometimes it matters, sometimes it doesn’t.

The narrative of Ai leading to mass efficiency and productivity gains for the economy as a whole will not be disrupted by arguments over depreciation schedules.

Burry’s sentiment and his critiques are legitimate. But we must respect the price action.

A break in the Ai trade will require a change on pace of infrastructure investment from a major hyperscaler. It will give the others cover to follow suit. And the reason for the down shift in investment could be Burry’s argument.

We just have to be honest and ask why the market has not recognized his perspective?

Point # 4 Hang in there, I’m bringing this all together

Throughout my career I’ve received more than my fair share of grief for hedging my comments, always saying “well, it depends.”

I can just feel the “it depends” spewing out of my prior points.

I am a natural skeptic. I want to keep my clients out of the market rat race. Constantly chasing the cheese, to their own detriment.

The reality of this market is, as with the internet cycle, the eventual winners are difficult to pinpoint, the new businesses and profit centers that will emerge from this technology are yet to be determined.

The news flow will continue to be disruptive. Earlier this year Chinese LLM DeepSeek caused a wave of selling across US tech, today Alphabet’s Gemini3 leads the LLM leader board. Impossible to nail, even for the tech bros.

How much time is left in this investment cycle, also impossible to nail.

My whole point with all of this is don’t get caught sleeping at the wheel. Diversification is paramount. There will be no alarm bells.

Cisco’s newsroom is a treasure trove of education. From February 2000 (5).

“The momentum of the Internet revolution continues to accelerate across both business and government sectors on a worldwide basis,” said John Chambers, president and CEO of Cisco Systems. “A University of Texas study found that in the U.S. alone the Internet Economy would account for more than $500 billion in revenues in 1999, an increase of more than 68% over 1998. This continued economic growth together with Cisco’s recognized expertise in the Internet, positions us to lead in the Internet Economy.”

The Market peaked shortly after in March of 2000.

As I wrote extensively in August, a barbell structure is the best approach to navigate this cycle. Remember, its about regret minimization.

Using a dial to control Ai exposure rather than a switch. And given the weight of evidence its ok to turn the dial down “a bit”. Your personal circumstances determine what “a bit” is. Get professional advice.

In the spirit of the holiday. 10 things I’m Thankful for...

My new business partners, I joined Laura, Sarah, and Marilou in January of 2025. They have welcomed me with open arms.

Ashely and Robin, who oversee our client experience and trading operation. Experienced professionals make my life much easier.

My clients, current, past, and future who have entrusted me with their wealth.

Healthy children! Having a toddler and a newborn during Covid; I look back and realize how crazy the time was, and I’m just happy they are thriving. Edee just finished her first softball season, and John Kelly his second t-ball season.

My wife! Business is easy when I don’t have the weight of running the household. I know most families have to deal with both, hats off. It’s also magical that there’s coffee made every morning.

My small group of friends who I can go without seeing for several months and just pick up where we left off, no grief involved.

My siblings! We are each so different from one another, yet we have managed to stay tight.

Having never felt the need to “keep up with the Joneses.” The transmission in my wife’s car blew up. What could have the potential to be a big headwind, is just a mild irritant. Live lean, manage liquidity appropriately.

I learned hard market lessons early in my career. I’m thankful I learned them then. I have a PTSD episode when I think about the name “FireEye”. Don’t bother looking it doesn’t trade anymore.

This business is notoriously difficult to navigate and survive. I’m grateful I’ve made it his far and hopeful that the robots are further away than most think.

Happy Thanksgiving, Merry Christmas, and Happy New Year, see you in 26’.

Financial Data via Koyfin.com 11.30.2025

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20251029.pdf

'Big Short' investor Michael Burry accuses AI hyperscalers of artificially boosting earnings

CISCO SYSTEMS REPORTS SECOND QUARTER EARNINGS AND TWO-FOR-ONE STOCK SPLIT

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. Tax planning and preparation services are offered through Prime Capital Tax Advisory. PCIA: 6201 College Blvd., Suite 150, Overland Park, KS 66211. PCIA doing business as Prime Capital Financial | Wealth | Retirement | Wellness | Family Office | Tax Advisory.