2026: Big Housing Shift - Part 1

“What’s the new economic paradigm? Parallel Prosperity”, said Treasury Secretary Scott Bessent at a Labor Day interview with the Washington Examiner.

Referring to the recent stagnation of lower and middle income Americans as they grapple with higher cost, and benefit less or not at all from a booming stock market. The administration wants to close this gap of prosperity between asset owners and providers of labor. The “have and have nots” so to speak.

Stocks on average were actually down in October, S&P 500 up. Same paradigm. Ai leading, everything else ho hum.

The Midterms are approaching, and the administration knows it takes time for policy changes to impact voters.

What can be done to improve the financial positions of most Americans?

Reduce rates and unfreeze the housing market.

“Confidence fell for consumers making less than $75K a year, but improved for most of the income groups making more than $75K, with the largest increase among those earning over $200K.”

Simple but not easy.

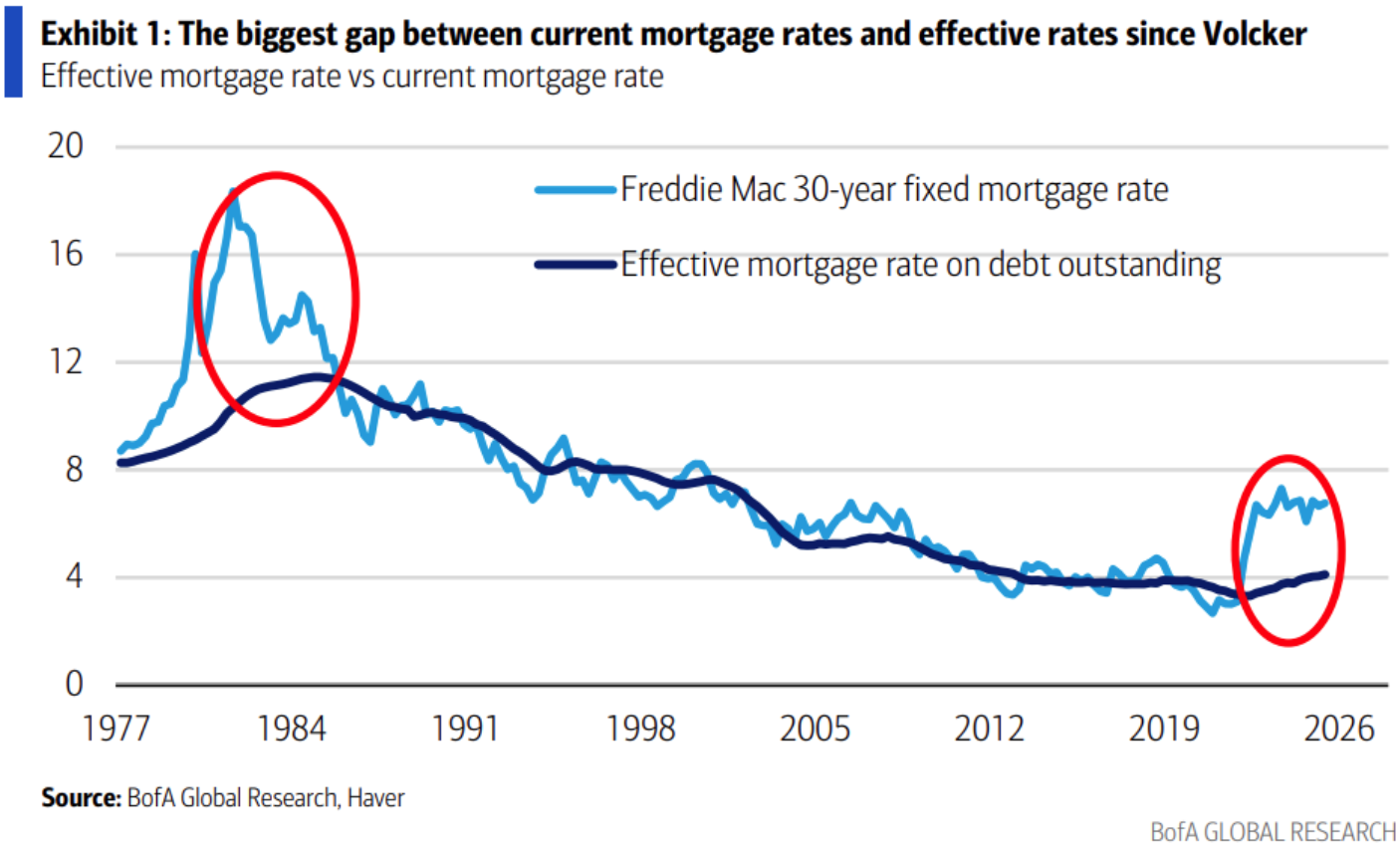

Close the gap between the current available mortgage rate and average existing mortgage rate, and drive a new housing cycle.

Per Sec. Bessent, “everything is on the table.” Including declaring a national housing emergency.